Calculate paycheck with 401k contribution

Ad Our 3-Minute Confident Retirement check can help you start finding the answers. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

401k Contribution Impact On Take Home Pay Tpc 401 K

This calculator uses the latest.

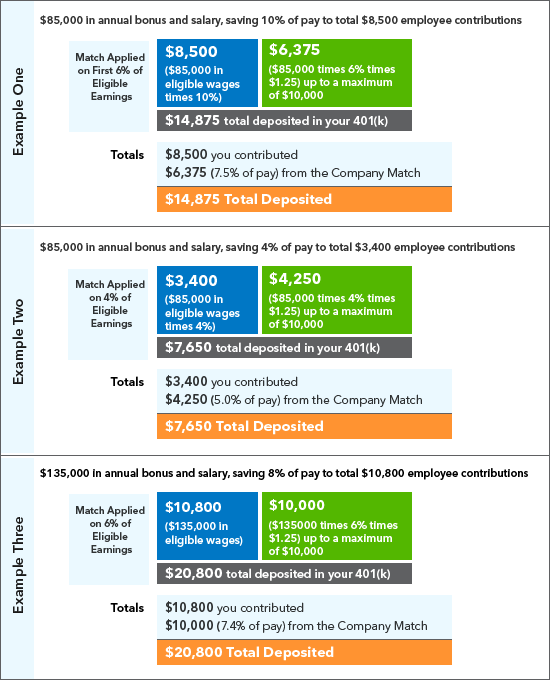

. Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a. Lower contributions to be done to max out the account. Use our retirement calculator to see how much you might save by the time.

When you make a pre-tax contribution to your. Learn About 2021 Contribution Limits Today. A One-Stop Option That Fits Your Retirement Timeline.

Get started and take the 3-Minute Confident Retirement check to start finding answers. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. A lower contribution limit can feel like theres a little less leg work ie.

If you increase your contribution to 10 you will contribute 10000. This calculator is provided only as a general self-help tool. The earlier you start contributing to a retirement plan the more the power of compound interest may help you save.

Your 401k plan account might be your best tool for creating a secure retirement. If you increase your contribution to 10 you will contribute 10000. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will.

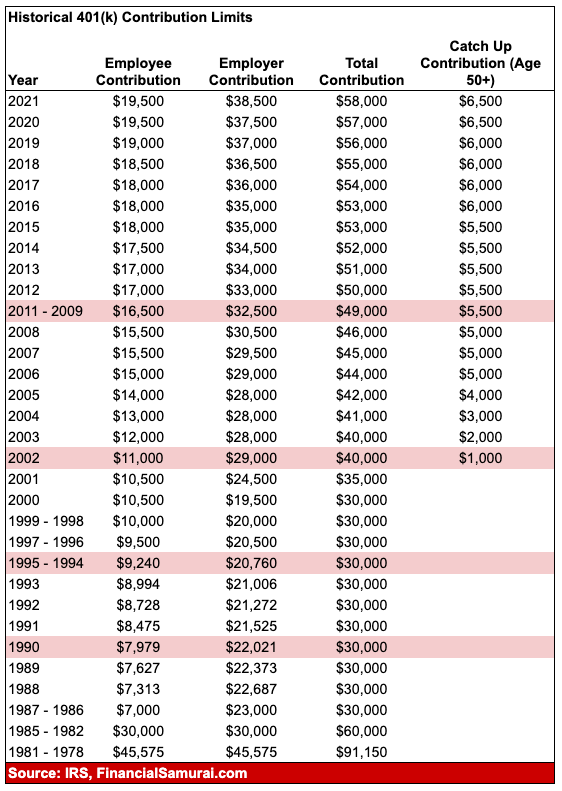

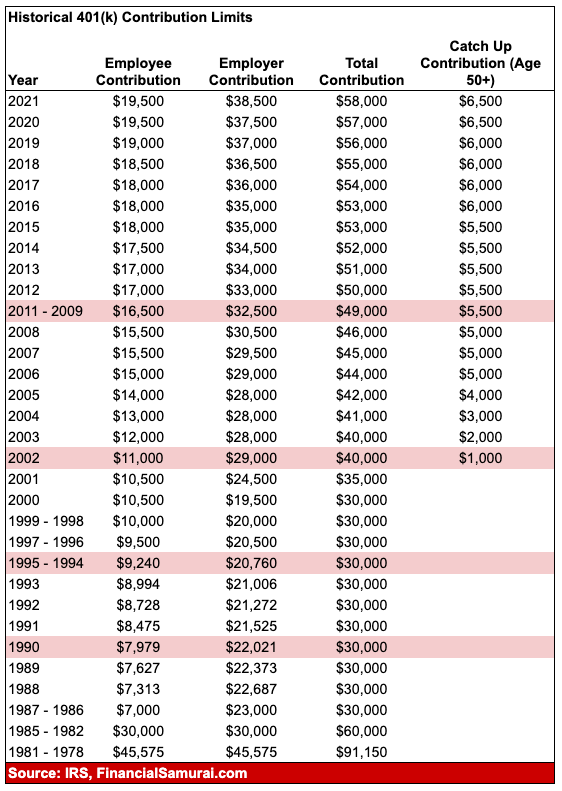

The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. Learn About 2021 Contribution Limits Today.

You only pay taxes on contributions and. A One-Stop Option That Fits Your Retirement Timeline. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings.

Calculators are provided by KJE Computer. Ad Discover The Benefits Of A Traditional IRA. Please note that your 401k plan.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. A 401 k match is an employers percentage match of a participating employees contribution to their 401 k plan usually up to a certain limit denoted as a percentage of the employees. According to the IRS you can contribute up.

Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement. 401 k Contribution Calculator. The accuracy or applicability of the tools results to your circumstances is not guaranteed.

You want to save for retirement and take advantage of your employers match in your 401 k plan but you arent sure you can afford to. Try changing your tax withholding filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay. We encourage you to talk to an.

Strong Retirement Benefits Help You Attract Retain Talent. Use this calculator to see how increasing your contributions to a 401 can affect your paycheck as well as your retirement savings. This calculator has been updated to.

Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. Ad Discover The Benefits Of A Traditional IRA. Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. This calculator uses the latest withholding. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Retirement Calculators and tools. This federal 401k calculator helps you plan for the future.

401k Contribution Calculator Step By Step Guide With Examples

Solo 401k Contribution Limits And Types

Free 401k Calculator For Excel Calculate Your 401k Savings

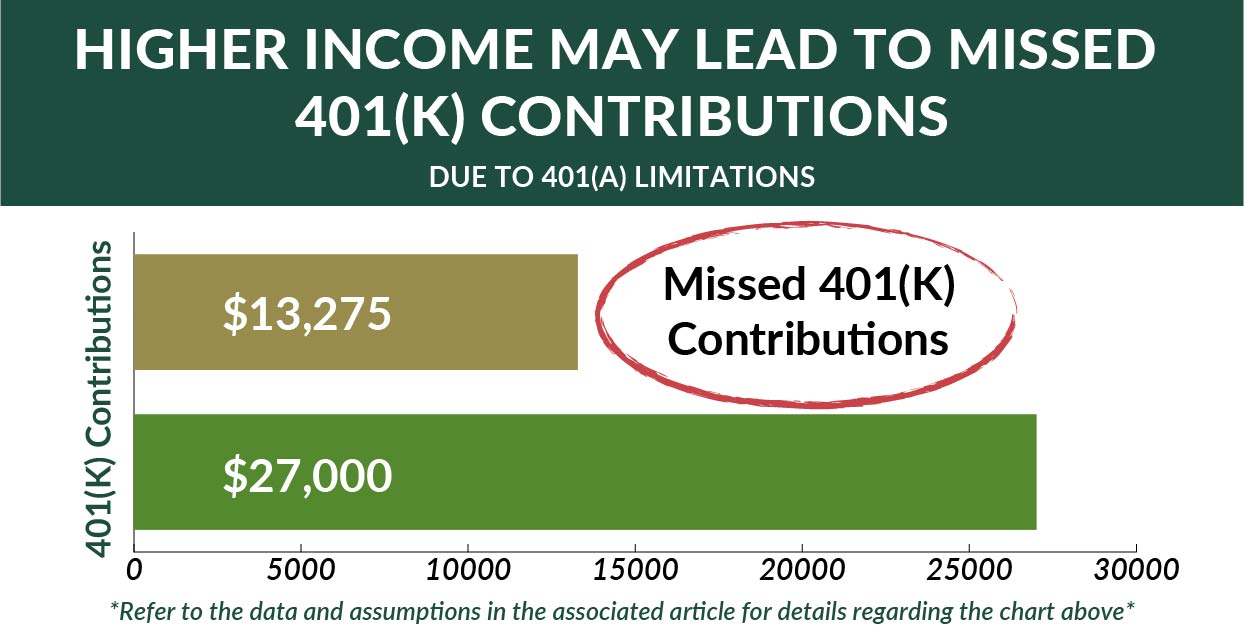

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

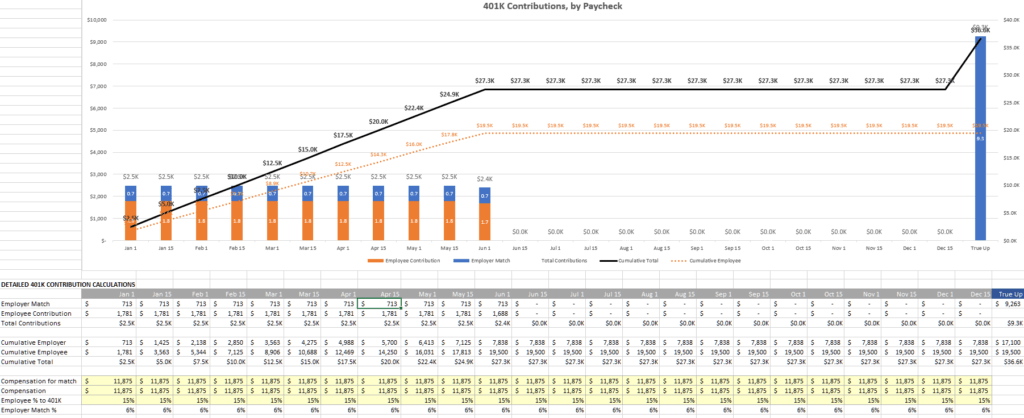

Strategies For Contributing The Maximum To Your 401k Each Year

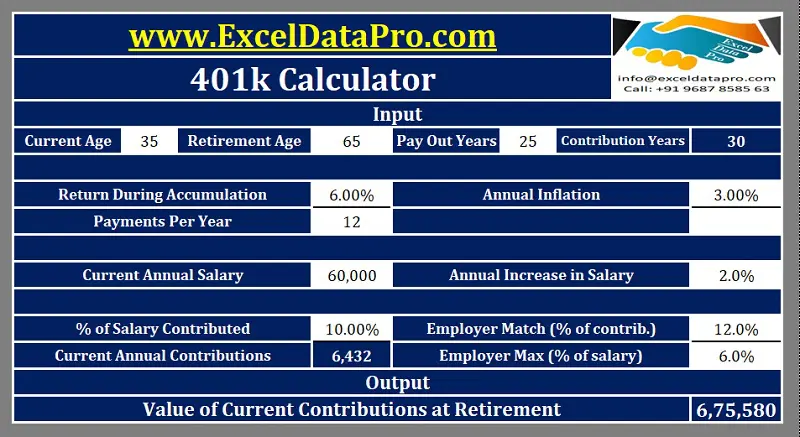

Download 401k Calculator Excel Template Exceldatapro

Download 401k Calculator Excel Template Exceldatapro

401 K Maximum Employee Contribution Limit 2022 20 500

401k Employee Contribution Calculator Soothsawyer

401k Contribution Impact On Take Home Pay Tpc 401 K

401k Employee Contribution Calculator Soothsawyer

401k Employee Contribution Calculator Soothsawyer

401k Calculator Paycheck Hot Sale 52 Off Www Ingeniovirtual Com

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

401 K Savings Plan Intuit Benefits U S

401 K Plan What Is A 401 K And How Does It Work