Calculate my equity

Once you know how much equity you have in your home you can determine if its sensible to borrow. Mortgage rates close in on 6 highest since 2008.

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Therefore for a company with no debt its assets and shareholders equity will be equal.

/debtequityratio_final-18c02abef4f74c1591dc9b12be962b1b.jpg)

. The credit available to you as a borrower through a home equity loan depends on how much equity you have. What is Equity Value. So if your home is worth 500000 and you still owe 200000 on your.

Net income is the total revenue minus expenses and taxes that a company generates during a specific period. Assets liabilities equity. The rate on the 30-year fixed mortgage jumped to 589 from 566 the week prior according to Freddie Mac.

Return on Equity. How to Calculate Shareholders Equity. In this case your equity in this example would be 120000.

For example suppose you purchased 100 shares of stock for 1 each for a total value of 100. Interest Rate Reduction Refinance Loans IRRRL are used to improve an existing VA loans terms when interest rates improve. The formula is Sale Price - Cost Basis Capital Gain.

Sum of shareholders equity 260280 ie the sum of equity capital and retained earnings Retained Earnings Retained Earnings are defined as the cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the. But if the company takes on new debt assets increase because of the influx of cash and equity shrinks because equity assets liabilities. Choosing a VA Lender.

Suppose that your home is worth 250000 and you owe 150000 on your mortgage. The amount of equity you have in your home impacts your finances in a number of ways it affects everything from whether you need to pay private mortgage insurance to what financing options may be available to you. Return on equity is a measure that analysts use to determine how effectively a company uses equity to generate a profit.

How long does it take to free up my equity when selling. How to calculate home equity To help reckon how much equity you have you can provide an estimate of your homes current value or get Read More a working estimate of how much your home is worth based upon whats happened to home prices in your market over time. The amount of your outstanding loans 200000 Your homes potential useable equity 400000 200000 200000.

To calculate your average GPA correctly add up the total number of points 1935 and then divide them by the number of credit hours 53. Calculating LTV and CLTV ratio. Also the ROE and the ROA will be equal.

When equity shrinks ROE increases. A cumulative high school GPA is tabulated similarly all you must do is add together all of the grade points and then divide by the total number of classes. A home equity line of credit or HELOC allows you to borrow against the equity of your home at a low cost.

You can calculate brokerage for all asset classes like Equity Intraday Equity Delivery Equity Futures Equity Options Currency Futures Currency Options Commodity. Check HELOC rates from top Canadian banks. Calculate how much you can borrow from your home using a Home Equity Line of Credit HELOC.

Calculate the difference. Along with Brokerage charges it will also give you a detailed understanding of other charges like transaction charges STT Stamp Duty for each State SEBI turnover charges. Home equity is the difference between the appraised value of your home and the amount you still owe on your mortgage.

Given most banks will likely lend you no more than 80 of your homes current value heres how to calculate your homes usable equity. Taking the value of the 2018 year Sum of total liabilities 45203. Shareholders equity may be calculated by subtracting its total liabilities from its total assetsboth of which are itemized on a companys balance sheet.

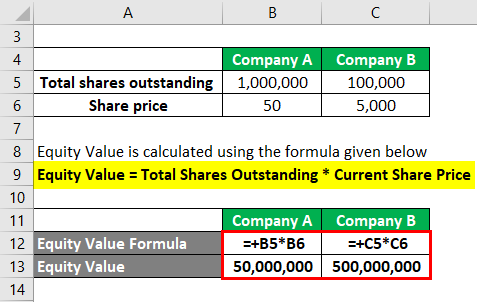

Cash-out Refinance Loans can be used to access a homes equity or to refinance a non-VA loan to a VA loan. Equity value commonly referred to as the market value of equity or market capitalization can be defined as the total value of the company that is attributable to equity investorsIt is calculated by multiplying a companys share price by its number of shares outstanding. Alternatively it can be derived by starting with the companys.

Unlike a mortgage or home loan its a flexible line of. In 2018 the typical US. 1935 53 365 Cumulative GPA.

It is obtained by taking the net income of the business divided by the shareholders equity. Even when you have equity in your home you probably wont be able to borrow all of it. The VA loan process begins like any other mortgage loan.

How to calculate home equity. Home spent between 65 and 93 days on the market from listing to. The average time between a home going under contract and closing is 45 days but that doesnt include the time it takes before you receive and accept an offer.

The difference between the buying price and the selling price is your capital gain or loss.

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-06-acd73a07b27f4ea38d124481e271fe49.jpg)

Calculating The Equity Risk Premium

Equity Formula Definition How To Calculate Total Equity

Owner S Equity Definition Formula Examples Calculations

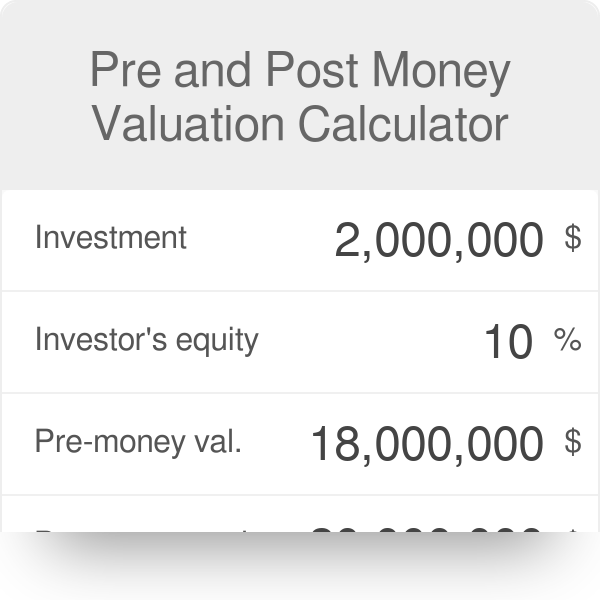

Startup Valuation Calculator Investment Equity Post And Pre Money

/debtequityratio_final-18c02abef4f74c1591dc9b12be962b1b.jpg)

Debt To Equity D E Ratio Formula And How To Interpret It

Equity Value Formula Calculator Excel Template

How Do You Calculate The Debt To Equity Ratio

:max_bytes(150000):strip_icc():gifv()/equity_final-da21918a6af144f39c6cd36c22397437.jpg)

Equity For Shareholders How It Works And How To Calculate It

Home Equity Calculator Free Home Equity Loan Calculator For Excel

How Do You Calculate The Debt To Equity Ratio

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

Stockholders Equity Definition

Cost Of Equity Ke Formula And Calculator Excel Template

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Loan Calculator Nerdwallet

Home Equity Calculator Free Home Equity Loan Calculator For Excel

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)

Debt To Equity D E Ratio Formula And How To Interpret It

Home Equity Calculator Free Home Equity Loan Calculator For Excel